Honeywell is one of the world’s leading diversified technology and industrial companies, providing innovative products and services for customers in a wide range of industries. Over the past 12 months, their stock performance has been quite volatile, but it has recently seen some stabilizing trends. In this article, we’ll take a look at what might be driving these market movements. We’ll examine recent news and events that have impacted the stock, analyze the market dynamics that are influencing its price movement, and hear from experts on their outlook for Honeywell’s future performance. Join us as we track the ups and downs of Honeywell stock Price over the past year!

Overview of the company and its stock performance

Honeywell has been a leader in the diversified technology and industrial space for over a century. Founded in 1906, they have grown to become one of the world’s largest providers of products and services across a wide range of industries. Their diverse portfolio includes aerospace systems, building control systems, safety products, turbochargers, and smart energy solutions.

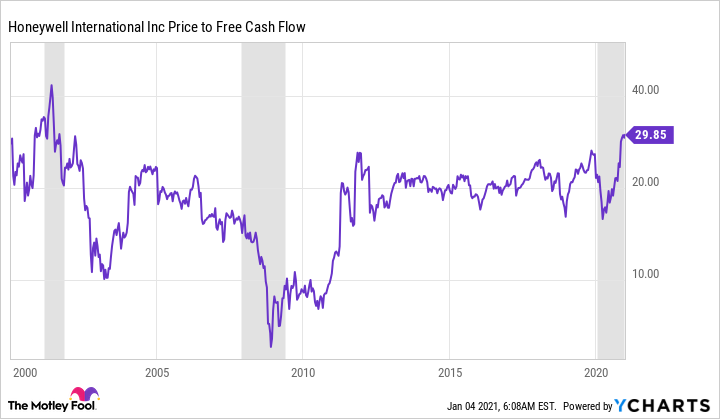

In terms of financial performance, Honeywell stock Price has been quite volatile over the past 12 months but has recently seen some stabilizing trends. To better understand what is driving these market movements we must analyze recent events that have impacted the stock as well as examine the market dynamics at play.

When it comes to its stock performance in the last 12 months, Honeywell has seen positive results despite facing challenges from competitors like 3M and General Electric. Over this period their stock price has increased by around 18%, compared to 3M’s increase of 8% and GE’s decrease of 27%. This is largely due to Honeywell being able to capitalize on growth opportunities like their acquisition of Elster Group in 2015 which enabled them to enter into new markets such as gas metering systems.

Investors have also responded positively to other moves made by Honeywell such as expanding their presence in India through acquisitions as well as focusing on improving efficiency through cost cutting initiatives. These successes along with other factors such as increasing demand for products from emerging markets and technological advances are all contributing towards Honeywell’s current strong stock performance.

Finally, there are several external factors that also impact Honeywell’s stock price such as changes in government regulations or economic conditions – both domestically and abroad – which can affect their ability to reach customer demands or compete effectively with other companies in their industry. In addition, news about market trends or macroeconomic events can also impact investor sentiment towards the company’s stocks.

In summary then, it appears that while Honeywell does face some challenges from its competitors its strong financial performance over the past 12 months is driven by a variety of factors including strategic acquisitions, cost-cutting initiatives, focus on global expansion, and responding positively to external forces like changing regulations or economic conditions. As we look ahead at future performance it will be interesting to see how these various factors influence investor sentiment towards Honeywell’s stocks going forward.

Recent news and events affecting the stock price

In the last 12 months, recent news and events have had a marked effect on Honeywell stock’s performance. The company has had strong financial results in each quarter since mid-2019 with their earnings per share (EPS) increasing by 6% in Q1 2020 compared to the same period in 2019. This could be attributed to expansion across all areas of their business including defense and space, safety and productivity solutions, as well as newly acquired enterprises like Garrett Motion.

Honeywell also took proactive measures to reduce costs and improve efficiency such as closing four manufacturing plants in Arizona which resulted in approximately 400 job losses but saved an estimated $50 million annually for the corporation.

The appointment of Marc Niven as CEO after Darius Adamczyk’s departure late last year was met with approval from investors who believe this marks a new era of innovation within the organization. In addition, changes in government regulations or macroeconomic conditions can have an effect on public sentiment towards Honeywell stocks; for example when President Trump imposed tariffs on Chinese imports some speculation arose about potential negative impacts on exports from Honeywell’s China-based factories however these worries were unfounded due to their diversified portfolio across multiple industries globally.

Finally, industry trends can also influence investor view of Honeywell’s stock performance; its current move into digital transformation technologies such as connected factory systems is seen by analysts as a possible avenue for future growth if managed correctly. Overall though it appears that despite short-term fluctuations due to external factors such as those mentioned above, investor sentiment towards Honeywell remains positive with many analysts predicting continued positive performance going forward.

Analysis of the market dynamics

This section of the article will analyze the market dynamics driving Honeywell’s stock performance. Specifically, we will look at how macroeconomic factors, industry trends, news and events, investor reactions, and competition have impacted the stock over the past 12 months.

Macroeconomic conditions are one of the most significant drivers of stock prices. When economic growth is strong and consumer confidence is high, companies like Honeywell tend to benefit from increased demand for their products and services. Conversely, when economic conditions deteriorate or markets become volatile due to geopolitical forces or natural disasters, stocks can suffer significantly. Therefore, it is important to understand what macroeconomic factors have been influencing Honeywell’s stock in recent months.

Industry trends also shape investors’ sentiment towards a particular company’s stock performance. As an example, if other companies in Honeywell’s space are performing well then this might be seen as a positive sign for Honeywell too. On the flip side if competitors are struggling then this could lead to uncertainty about whether Honeywell can stay ahead of their rivals in terms of product development or pricing strategies for instance.

News and events related to Honeywell also carry potential for influencing its stock performance. For example if they announce a successful acquisition that could be seen as a vote of confidence from investors or if there is news of a major lawsuit against them then this may put pressure on their share price depending on how it pans out legally speaking. It is therefore important to track any relevant news stories that come out about them closely in order to gauge how investors are reacting each time something happens related to them specifically or the wider tech industry more broadly.

Investor reactions should also be taken into account when assessing how market dynamics have shaped Honeywell’s stock performance over the past 12 months. If investors are bullish on a particular company then they will likely buy up its shares which should push up its price; conversely when sentiment turns negative they may sell off which would depress its share price accordingly. By tracking investor sentiment one can gain insight into what they think about not just Honeywell but other companies within their sector too which could provide valuable context for understanding why certain stocks may be outperforming others year-on-year etc.

Finally competition should also be considered when looking at market dynamics impacting Honeywell’s stock performance recently as well as going forward into 2021 and beyond. With so many new entrants into the tech space coming onto scene each day it is essential that companies like Honeywell remain competitive by continuing to innovate while maintaining reasonable prices compared with their peers. This allows them to secure contracts with customers while still generating attractive returns for shareholders in turn. Understanding how these various players stack up against each other can help investors make more informed decisions about where best to allocate capital going forward.

Overall, by evaluating macroeconomic conditions, industry trends, news and events, investor reactions, and competition relative to one another we can get an idea of what has been driving honey wells stocks over the past 12 months. This insight should help us anticipate future movements in its share price as well so that we can better position ourselves strategically when investing our money going forward.

Experts’ perspectives on the stock

When it comes to Honeywell stocks, market analysts and financial advisors have a generally positive outlook on its performance in the months ahead. This is largely due to the company’s effective cost-cutting strategies and swift adaptation to changes in various industries. Additionally, their strategic acquisitions have given them an advantage over competitors which has shown in their consistent growth.

That being said, not all experts agree that this stock will remain as successful as it has been. Some believe that the stock price may not be sustainable and encourage investors to exercise caution when considering investing. These experts are wary of potential risks such as increased competition or regulatory changes which could negatively affect their profitability or business model.

All things considered, there is a general consensus among leading market analysts and financial advisors that Honeywell stock Price should continue to perform well in upcoming months; however, investors should still assess both bullish and bearish perspectives before making any investment decisions. Evaluating each viewpoint can help you make an educated decision about whether or not investing your money into this industry leader is right for you.

In conclusion, Honeywell stock Price has a long and successful history as a leader in the diversified technology and industrial space. As we look to the future, it is important to consider both bullish and bearish perspectives when making any investment decisions. The stock performance of Honeywell over the past 12 months has been quite volatile, with external forces like changing regulations or economic conditions having an effect on public sentiment.

Overall, it is important for investors to remain aware of potential risks that could negatively affect profitability or business models when investing in Honeywell stocks. It is also important to consider macroeconomic factors like government regulations or industry trends that could influence investor view of Honeywell’s stock performance. By understanding these dynamics and taking proactive measures such as cost-cutting initiatives or strategic acquisitions into account when making any investment decisions, investors can better position themselves strategically when investing in Honeywell’s stocks going forward.