Are you looking to gain insight into investing in GlaxoSmithKline (GSK) stock? This article provides an overview of GSK and the key factors to consider before investing, as well as insider tips and techniques for successful investing. We’ll explore the risks and benefits associated with investing in GSK and GlaxoSmithKline stock, and provide an outlook for the future of the company’s stock. Read on to learn more about how you can make informed investments in GSK stock.

Overview of GlaxoSmithKline stock

GlaxoSmithKline (GSK) is a British multinational pharmaceutical company with operations in over 115 countries and annual revenues of around £30 billion. The company specializes in the research, development, production, and marketing of pharmaceuticals, vaccines, and consumer healthcare products. GSK has also invested heavily in research and development to develop new treatments for diseases such as HIV/AIDS, malaria, cancer, and diabetes.

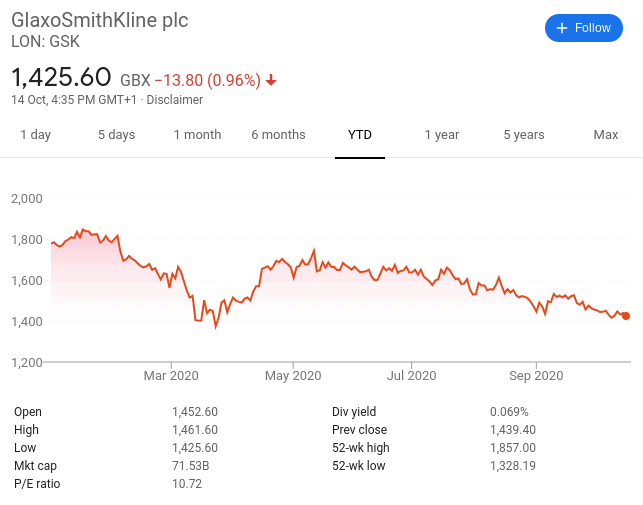

For investors looking to gain insight into investing in GSK stock, understanding its current performance is crucial. Currently, GSK’s stock is trading at around 1,500 GBX per share which is slightly lower than it was earlier this year but still up from last year’s levels. The company’s stock has seen a lot of volatility throughout the years due to changes in regulatory requirements and economic conditions. Despite these fluctuations though, GSK’s stock price has consistently been among the top performers on the London Stock Exchange since its introduction in 1986.

The history of GSK’s stock can provide valuable insight into how the company’s performance has evolved over time. In recent years there have been several important events that have had an impact on the stock price including acquisitions such as Novartis AG’s acquisition of Glaxo Wellcome plc in 2000 for $75 billion USD; spin-offs such as ViiV Healthcare’s spin-off from GSK in 2015; mergers such as Pfizer Inc.’s merger with GSK’s consumer healthcare business in 2018; and strategic investments like Nestle SAs’ purchase of a majority stake in GSK Consumer Health Care business for $10 billion USD earlier this year.

In addition to these more notable events, there have been several other pieces of news that have impacted GSK’s stock price during 2019 including changes to their dividend policy as well as announcements regarding regulatory approvals for various drugs developed by the company. Investors should pay close attention to any news or developments related to GSK that could affect their investments going forward.

Finally, investors should consider what expectations they may have about future performance when deciding whether or not to invest in GSK stock. Although past performance does not guarantee future success investors should be aware that there are both risks and rewards associated with investing including potential returns on capital but also potential losses if market conditions change unexpectedly or if regulatory issues arise which could negatively impact pricing or sales volumes etc Additionally, investors should be aware of any major technological advances or innovations that could potentially disrupt industries or markets where GSK operates which could result in unexpected shifts in market dynamics making it difficult for companies like GlaxoSmithKline to remain competitive going forward.

Key factors to consider before investing

Investing in GlaxoSmithKline stock (GSK) stock can be a tricky and complex process. Before deciding whether to invest, it is important to consider the various factors that could impact the success of your investment. Here are some key factors to keep in mind:

1. Analyzing the Company Profile: Understanding GSK’s history, financial performance, market share, competitive landscape, and other details can help investors better understand the company and its stock. Investors should assess GSK’s current standing in terms of its strength relative to competitors and whether or not it is well-positioned to grow in the future.

2. Researching Current Stock Trends: It is also important for potential investors to research current trends in GSK’s stock price. They should assess how much the price has changed over time, whether there have been any significant changes recently due to news events or other factors, and if there are any patterns emerging that they should be aware of before investing.

3. Checking Financial News and Reports: Investors should stay up-to-date with GSK’s financial news by regularly checking official reports such as quarterly earnings results or annual reports from the company’s management team. By doing so, investors will gain an understanding of how well (or poorly) GSK has been performing financially and if there are any red flags that could potentially affect their decision-making process when considering investing in GSK stock.

4. Understanding Macroeconomic Forces: Investors must be aware of macroeconomic forces such as economic growth rate, inflation rate, unemployment rate, etc., as these elements can have a direct impact on a company’s stock price over time – both positively and negatively depending on circumstances. Therefore it is essential for investors to do their homework before investing in order to gauge the potential risks associated with their chosen investment option(s).

By taking all of these factors into consideration when looking into GSK stock specifically or any other investments generally speaking – potential investors will be better equipped in making decisions based on reliable information rather than hearsay or speculation alone which may lead them down an uncertain path leading potentially disastrous outcomes for their investments instead of successful ones!

Insider tips techniques for investing

Investing in GlaxoSmithKline (GSK) stock can be a lucrative way to diversify one’s portfolio and gain exposure to the healthcare industry. Before investing however, it is essential that potential investors conduct comprehensive research into the company’s strategies, latest developments, financial performance and track record. With this knowledge at hand, investors will be better equipped to make informed choices when deciding whether or not GSK stock is right for them.

In addition to researching the fundamentals of GSK stock, technical analysis may also prove useful in predicting future price movements. By studying past and current stock prices, patterns or signals may be discovered which could provide insight into whether a particular stock is likely to rise or fall in value. This information can then be used by investors when entering or exiting positions with GSK stocks.

Creating a well-balanced portfolio is another effective way of mitigating risk when investing in GSK stocks. An investor can achieve this balance by including both technology stocks as well as those from other industries such as healthcare and pharmaceuticals where GSK operates within their portfolio; providing protection should one sector take a downturn due to external factors such as economic conditions or regulatory issues.

Finally, investors should consider how technological innovations might impact the industries within which GSK operates in the future – particularly given the disruptive power of modern technologies demonstrated by companies like Amazon over recent years.. Keeping up-to-date with these trends will enable more informed decision making when investing with GSK stocks and GlaxoSmithKline stock or any other investments made along similar lines.

By using these insider tips and techniques for investing, potential investors will have an increased chance of achieving success when considering whether they should invest in GlaxoSmithKline (GSK) stocks. Researching key factors such as strategies and financial statements alongside utilizing technical analysis tools and creating a diversified portfolio are all invaluable tactics that can help ensure long term success when investing with GSK stocks.

In conclusion, investing in GlaxoSmithKline (GSK) stock can be a rewarding experience if done right. It is important to understand the company’s strategies and research current stock trends, macroeconomic forces, analyst opinions and ratings before making any decisions. Utilizing technical analysis and creating a well-balanced portfolio are two key techniques which could help investors maximize their returns whilst reducing risk. This blog post has provided some valuable insights into the potential rewards and risks associated with GSK investments; however, it is up to each individual investor to assess whether or not it is suitable for them. Before making any investment decision, investors should ensure they compare all available options against their own financial goals for a successful outcome.

![How To Fix Acknowledgment [pii_email_47d6d05800e76df67e02] Error](https://www.bigentreprenuer.com/wp-content/uploads/2023/03/Fixing-Mailchimp-Issues-of-pii_email_84eb7572bd91baae7e9f.webp)