As an investor or trader, understanding market volume is crucial to making informed decisions about buying or selling securities. Market volume is a measure of the total number of shares or contracts traded during a specific period, such as a day, week, or month. It provides valuable information about the level of activity and liquidity in a particular market or asset.

The importance of MV

MV is an important indicator of market sentiment and can help traders and investors determine the direction of the market. High volumes indicate strong interest and can be a signal of a bullish or bearish trend. Conversely, low volumes suggest that there is less interest and can be an indication of market uncertainty or indecision.

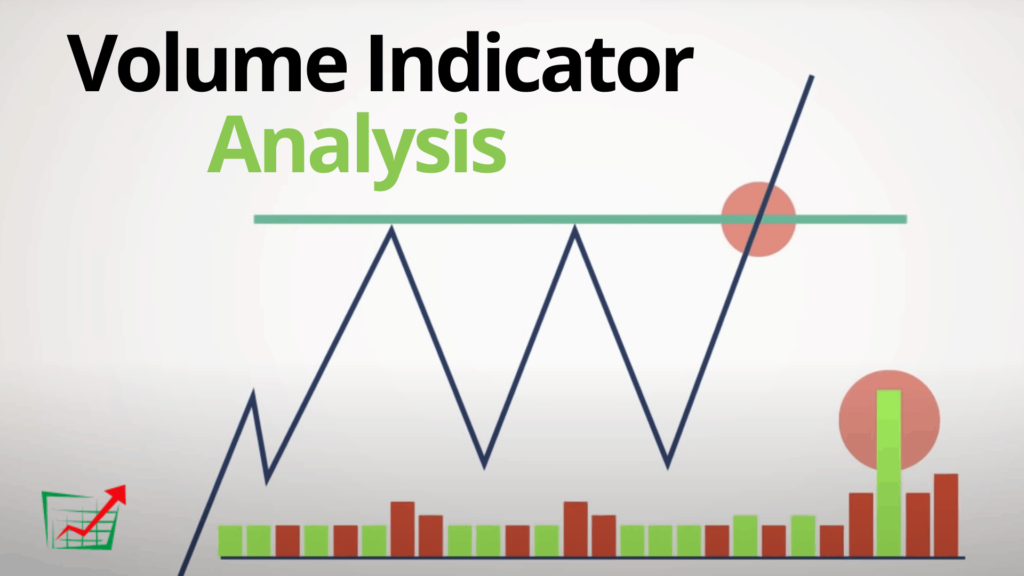

Volume can also be used to confirm trends or identify potential reversals. For example, if a stock is experiencing an upward trend and volume is increasing, it suggests that there is strong buying pressure and the trend is likely to continue. On the other hand, if a stock is experiencing an upward trend but volume is decreasing, it may be an indication that the trend is losing momentum and a reversal could be imminent.

Analysis of MV

There is several tools and strategies that traders and investors can use to analyze MV. One common approach is to use technical analysis, which involves examining price charts and identifying patterns and trends. Technical analysts often look for divergences between price and volume, which can signal potential market shifts.

Another approach is to use volume indicators, such as the on-balance volume (OBV) indicator or the volume-weighted average price (VWAP) indicator. These indicators use volume data to provide insights into market sentiment and can help traders and investors identify potential entry and exit points.

In addition, traders and investors can use MV to inform their risk management strategies. For example, if a stock has low volume and high volatility, it may be more difficult to buy or sell large positions without significantly impacting the price. Understanding MV can help traders and investors identify and mitigate potential risks.

Technical analysis is one of the most popular approaches to analyzing MV. Technical analysts use a variety of tools and indicators to study price charts and identify patterns and trends. Some of the most commonly used technical indicators include moving averages, relative strength index (RSI), and moving average convergence divergence (MACD). By analyzing these indicators in conjunction with MV, traders and investors can gain a deeper understanding of market sentiment and make more informed decisions.

Volume indicators are another powerful tool for analyzing MV. These indicators use volume data to provide insights into market sentiment and can help traders and investors identify potential entry and exit points. For example, the on-balance volume (OBV) indicator is a popular volume indicator that measures buying and selling pressure. When the OBV is rising, it suggests that buying pressure is increasing and the stock price is likely to follow. Conversely, when the OBV is falling, it suggests that selling pressure is increasing and the stock price is likely to decline.

In addition to technical analysis and volume indicators, traders and investors can also use MV to inform their risk management strategies. For example, if a stock has low volume and high volatility, it may be more difficult to buy or sell large positions without significantly impacting the price. In such cases, traders may need to adjust their position sizes or use more sophisticated trading strategies, such as limit orders or stop-loss orders.

Overall, understanding MV is a critical component of successful trading and investing. By analyzing MV and using it to inform their trading strategies, traders and investors can gain a deeper understanding of market sentiment, identify potential entry and exit points, and manage their risks more effectively. Whether you are a seasoned trader or a novice investor, mastering the art of MV analysis is an essential skill that can help you achieve your financial goals.

In conclusion, market volume is a crucial aspect of trading and investing that cannot be ignored. It provides valuable information about the level of activity and liquidity in a particular market or asset and can help traders and investors make informed decisions about buying or selling securities. Understanding MV is essential to identifying potential trends, confirming trends, and identifying potential reversals. It is also a key tool for risk management, as low volume and high volatility can pose significant risks to traders and investors.

Technical analysis, volume indicators, and risk management strategies are some of the most common approaches to analyzing MV. By combining these techniques and using market volume to inform their trading strategies, traders and investors can gain a deeper understanding of market sentiment and make more informed decisions.

Ultimately, mastering the art of MV analysis is an essential skill for traders and investors at all levels. It requires patience, discipline, and a willingness to learn from both successes and failures. By keeping a close eye on MV and using it to inform their trading decisions, traders and investors can increase their chances of success and achieve their financial goals.