McKesson Corporation, a leading healthcare services, and information technology company, has garnered attention from investors seeking opportunities in the healthcare sector. Understanding the potential of McKesson stock requires a comprehensive evaluation of key factors that can influence its performance. In this article, we will conduct an in-depth analysis of McKesson’s financial performance, competitive position, industry outlook, strategic initiatives, risk factors, and market sentiment to provide insights into its investment potential.

Financial Performance and Growth Metrics:

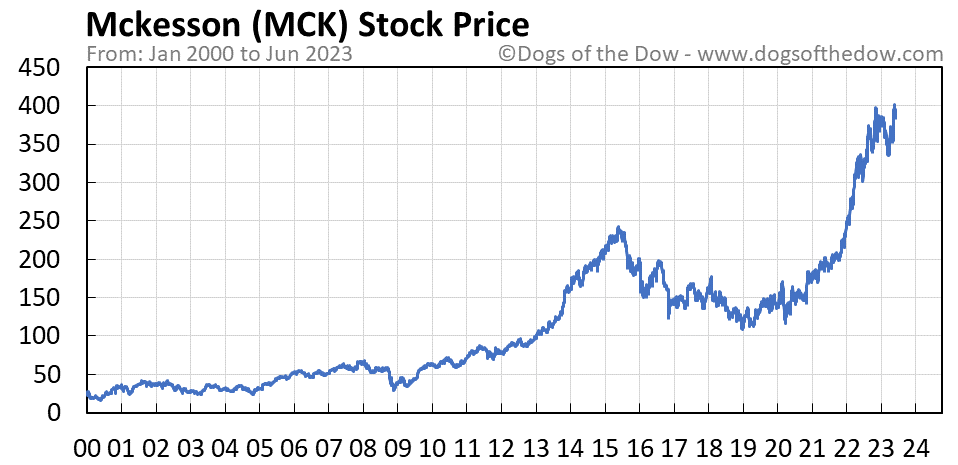

To assess the potential of McKesson stock, we must first examine its financial performance. Over the past several years, McKesson has demonstrated consistent revenue growth, driven by its strong position in the healthcare supply chain. Factors such as a diverse revenue stream, expanding customer base, and strategic acquisitions have contributed to McKesson’s positive financial trajectory. We will delve into key financial metrics, including revenue growth, profitability, operating margins, return on investment, and compare them to industry benchmarks.

Competitive Landscape and Market Position:

McKesson operates in a highly competitive market within the healthcare industry. Analyzing its competitive landscape will help us understand McKesson’s market position and its ability to maintain a competitive advantage. We will evaluate the company’s market share, strategic partnerships, technological capabilities, and supply chain efficiency. Additionally, we will examine the impact of industry trends, such as the increasing focus on digital healthcare solutions and the evolving regulatory environment, on McKesson’s competitive position.

Healthcare Industry Outlook:

The healthcare industry offers significant growth potential, driven by factors such as aging populations, increasing healthcare expenditure, and technological advancements. Understanding the industry outlook is crucial for evaluating McKesson’s growth prospects. We will explore emerging trends, such as telehealth, data analytics, and personalized medicine, and assess how McKesson is positioned to capitalize on these opportunities. Additionally, we will consider regulatory changes and potential risks that could impact McKesson’s operations and growth trajectory.

Business Strategies and Initiatives:

McKesson’s strategic initiatives play a pivotal role in determining its long-term potential. We will analyze the company’s investments in healthcare technology, digital solutions, and supply chain optimization. By evaluating McKesson’s efforts to drive operational efficiencies, expand its product and service offerings, and adapt to changing customer needs, we can assess its ability to remain competitive and sustain growth in a rapidly evolving healthcare landscape.

Risk Factors and Mitigation Strategies:

Identifying and evaluating risk factors is crucial for a comprehensive analysis of stock. We will discuss regulatory risks, pricing pressures, potential litigation, and supply chain disruptions. Additionally, we will explore how McKesson manages these risks through compliance programs, risk mitigation strategies, and diversification of its business lines. Understanding the potential challenges and their impact on McKesson’s financial stability and growth potential is essential for investors.

Analyst Recommendations and Investor Sentiment:

Investor sentiment and analyst recommendations provide valuable insights into the market perception of McKesson stock. We will review the consensus analyst rating, target price forecasts, and institutional ownership to understand how experts assess McKesson’s investment potential. Furthermore, we will consider recent news and market sentiment to gauge the overall sentiment towards stock.

In conclusion, after conducting a comprehensive evaluation of McKesson Corporation and its stock potential, several key insights emerge. McKesson has exhibited strong financial performance, with consistent revenue growth and profitability, driven by its prominent position in the healthcare supply chain. The company’s diverse revenue streams, expanding customer base, and strategic acquisitions have contributed to its positive trajectory.

Competitively, McKesson holds a solid market position, supported by its market share, strategic partnerships, and efficient supply chain. However, the healthcare industry is dynamic and subject to regulatory changes, making it essential for McKesson to adapt to evolving trends and maintain its competitive advantage.

The healthcare industry as a whole offers substantial growth prospects, fueled by factors such as increasing healthcare expenditure and technological advancements. McKesson is well-positioned to capitalize on these opportunities, particularly in areas like digital healthcare solutions and supply chain optimization. By investing in technology and pursuing operational efficiencies, McKesson demonstrates its commitment to staying ahead of industry trends.

While McKesson’s stock potential is promising, it is crucial to acknowledge the associated risks. Regulatory risks, pricing pressures, litigation, and supply chain disruptions pose challenges that require careful management. McKesson’s compliance programs, risk mitigation strategies, and diversification efforts mitigate these risks to a certain extent.

Analyst recommendations and investor sentiment toward McKesson stock generally reflect positive sentiment, considering the company’s financial performance, industry outlook, and strategic initiatives. However, individual investors should conduct their own due diligence and consider their investment objectives, risk tolerance, and time horizon before making any investment decisions.

In summary, McKesson Corporation exhibits strong potential as an investment option, with its solid financial performance, competitive position, industry growth prospects, strategic initiatives, and positive market sentiment. Nevertheless, investors should carefully evaluate the associated risks and align their investment decisions with their specific financial goals and risk tolerance. Consulting with a qualified financial professional is advisable to make informed investment choices.